— PROJECT NAME

DBS Mini

— ROLE

Design Strategy

Design Research

User Testing

Workshop Master

— TEAM

Ng Luo Wei

Seah Li Ping

Teng I-Ling

Chang Zi Xin

— Supervisor

Asst Prof Dr. Jung-Joo Lee

— DATE

Aug – Oct 2017

13 Weeks

To design a wearable technology with a digital payment function for teenagers.

DBS Bank is a Singaporean multinational banking and financial services corporation

WHY A WEARABLE WITH DIGITAL PAYMENT?

In 2014, the Singapore government launch a smart nation initiative to transform the country into the digital age. The key pillars this initiative is Digital Economy, Digital Government and Digital Society – of which digital monetary transaction holds an important role to the government as well as banks

Furthermore, in 2017, they launch the POSB Smart Buddy a subsidary bank of DBS. This product targets primary school students (age 6 – 12) and their schools alongside the parents to shape this digital culture from young as well as tracking savings for students.

The product has been proven a great proof of concept and DBS Bank wants to expand their reach and capabilities of wearables and digital payment function targetting at a different customer segments teenagers (age 13 – 19)

START OF PROJECT

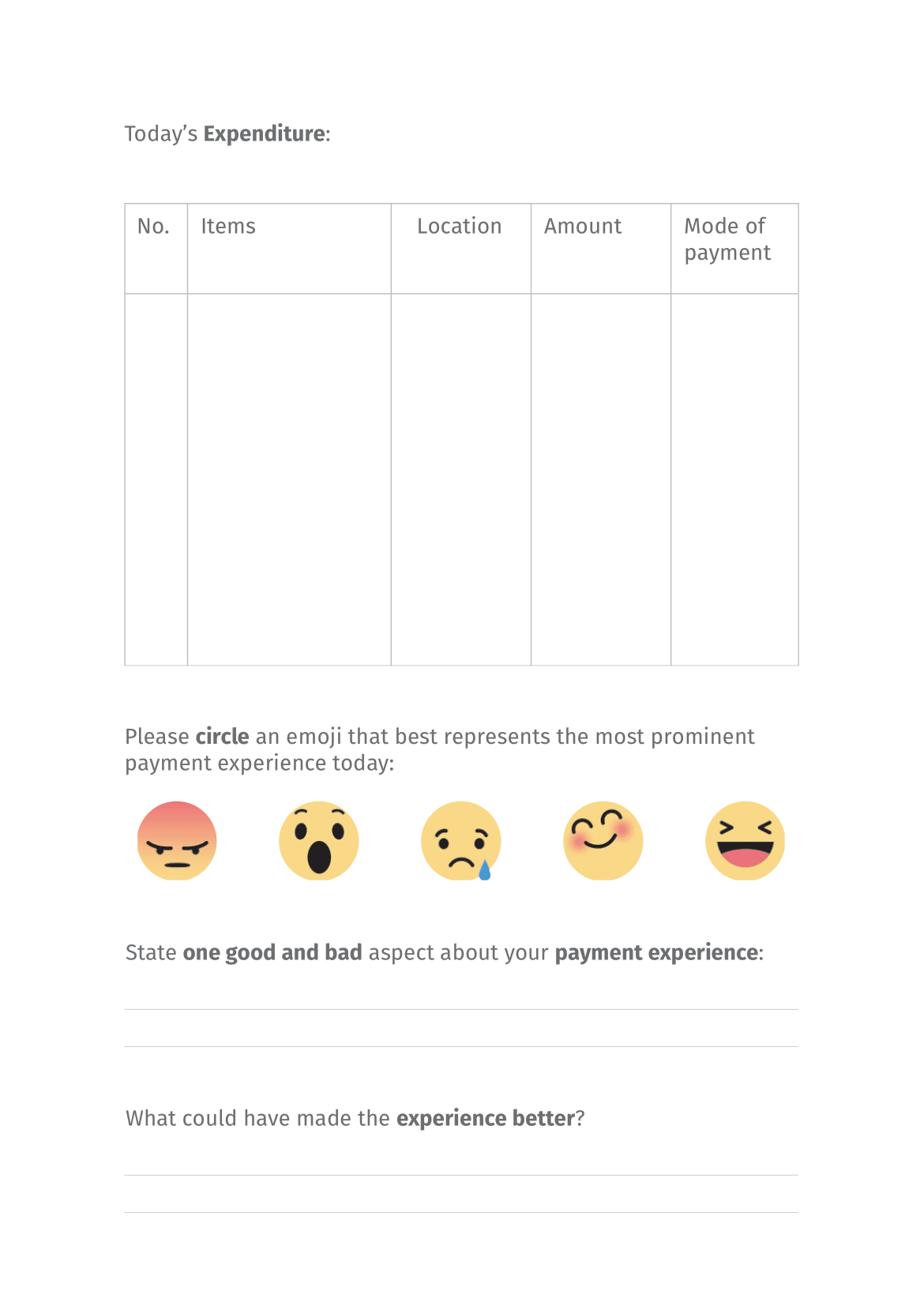

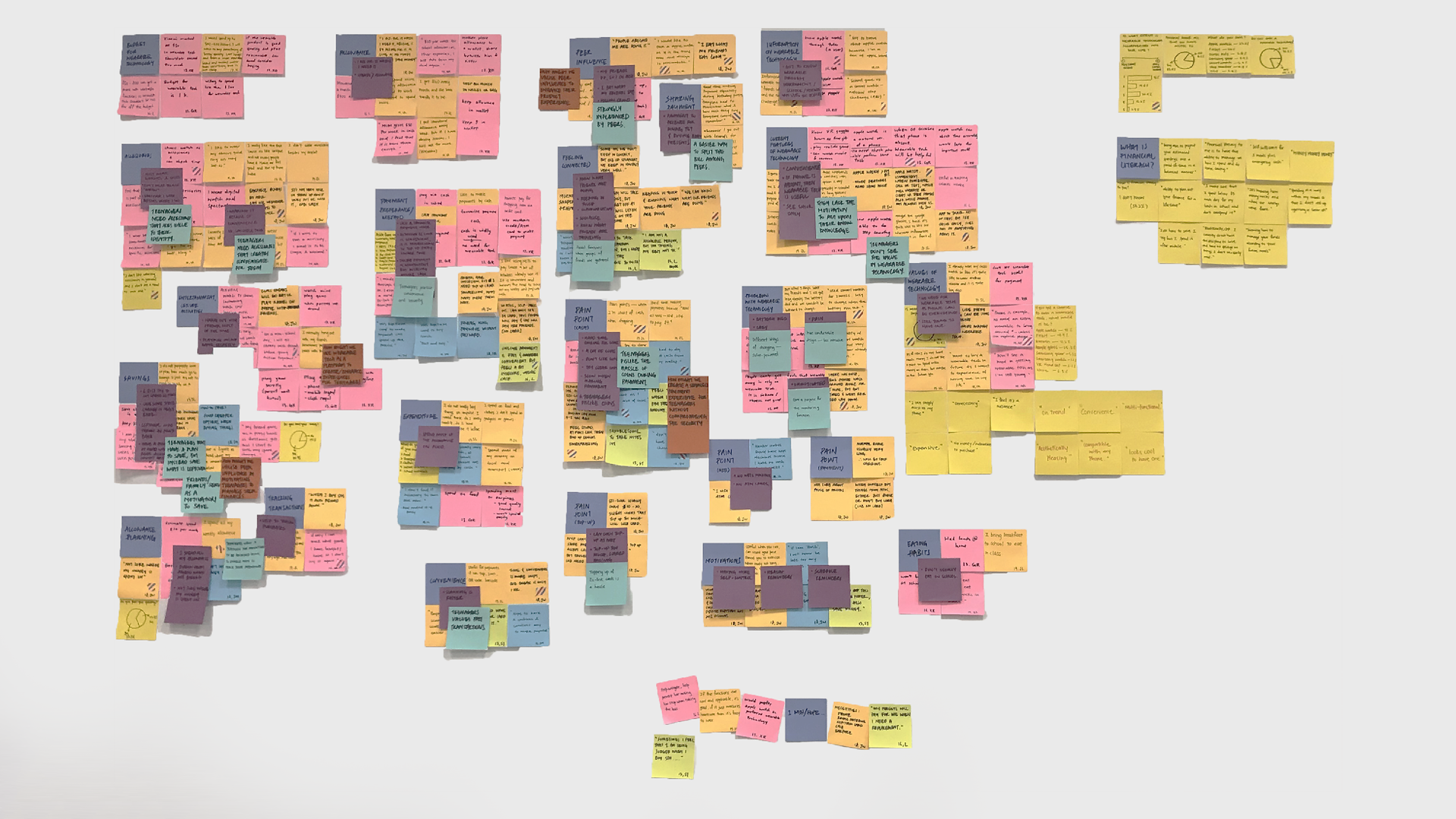

Interviewing 8 teenagers to understand

1) Thoughts and feelings about a wearable technology

2) Spending and purchasing habits

3) Saving methods

4) Aspiration and goals

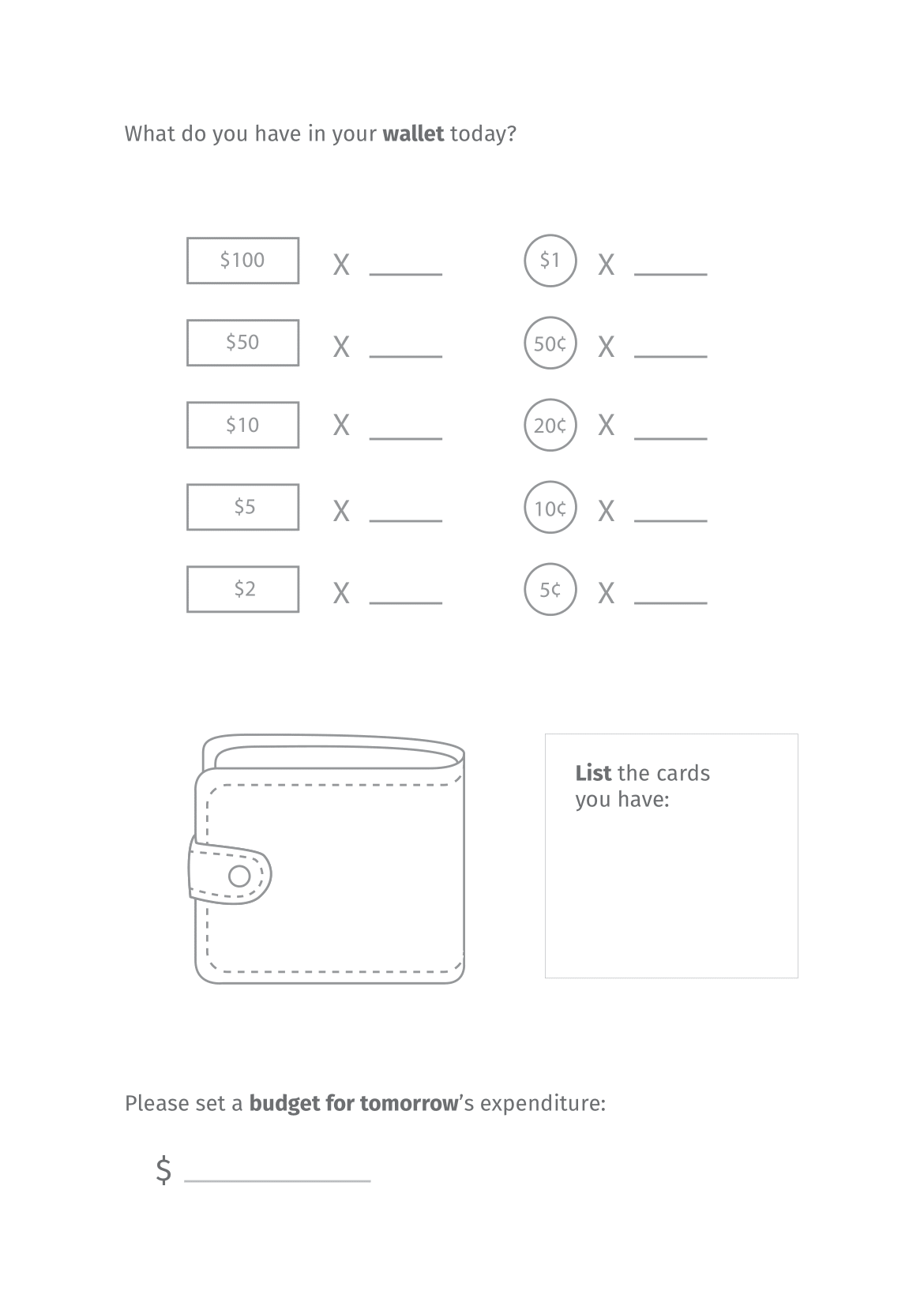

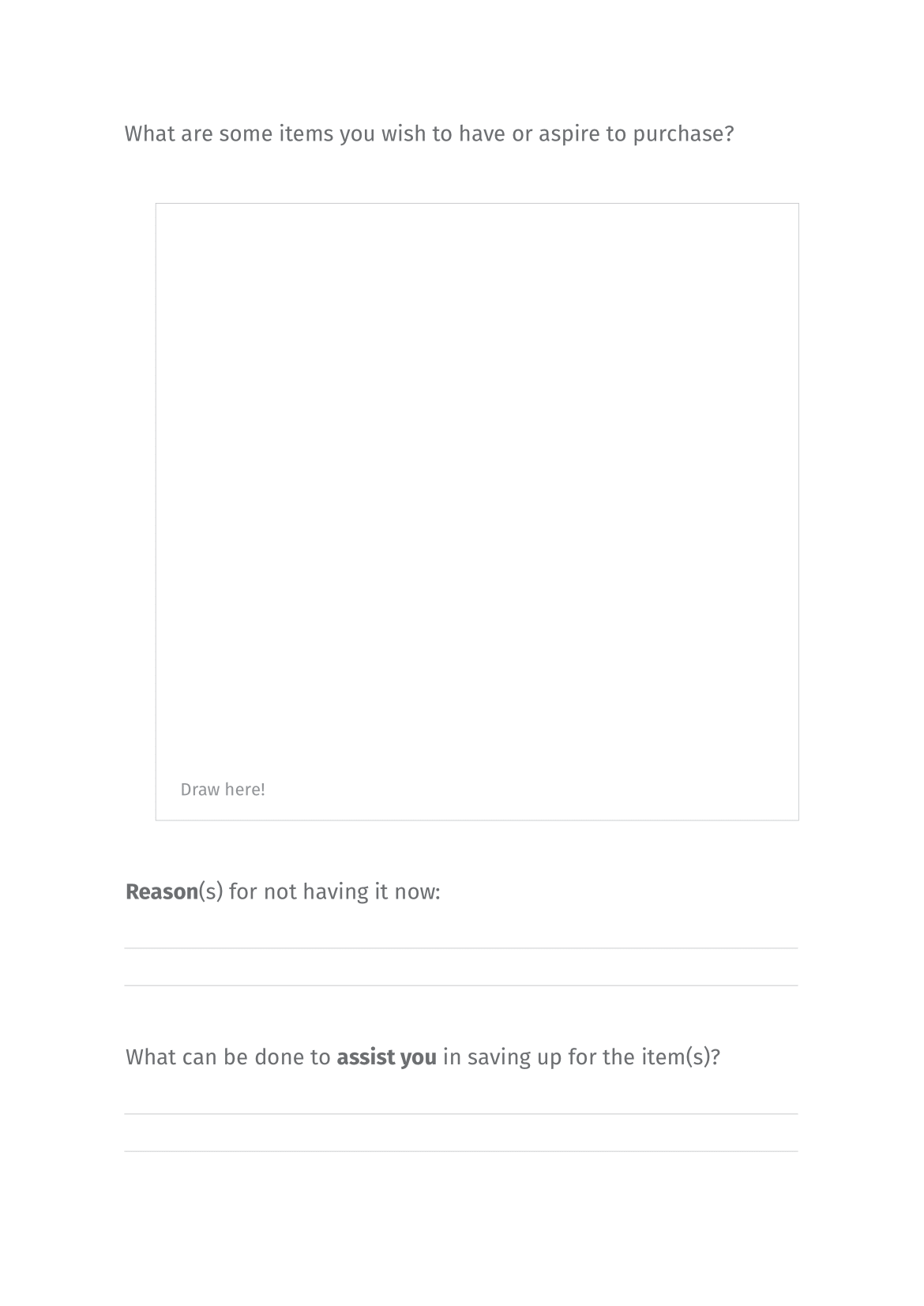

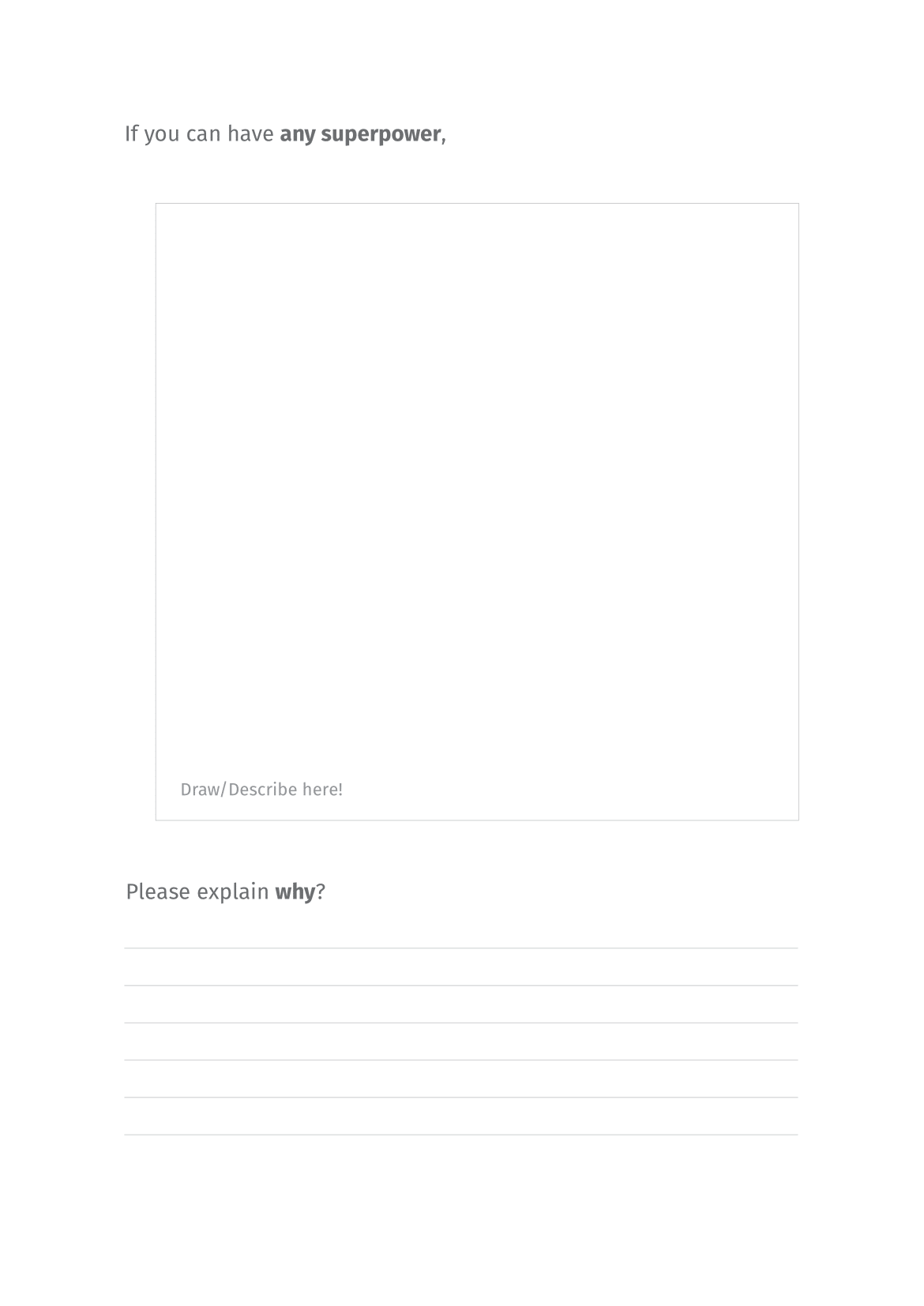

Along side interview, we gave out 4-day design journals to some of our interviewees to gain more understanding of their daily routine. Inside the journal requires the teenager to share what their OOTD (out fit for the day is) and what they are in their pockets and bag for the day.

At this point we believe gathering this information could help informed us as to what typology of a wearable should we be desiging.

Along side interview, we gave out 4-day design journals to some of our interviewees to gain more understanding of their daily routine. Inside the journal requires the teenager to share what their OOTD (out fit for the day is) and what they are in their pockets and bag for the day.

At this point we believe gathering this information could help informed us as to what typology of a wearable should we be desiging.

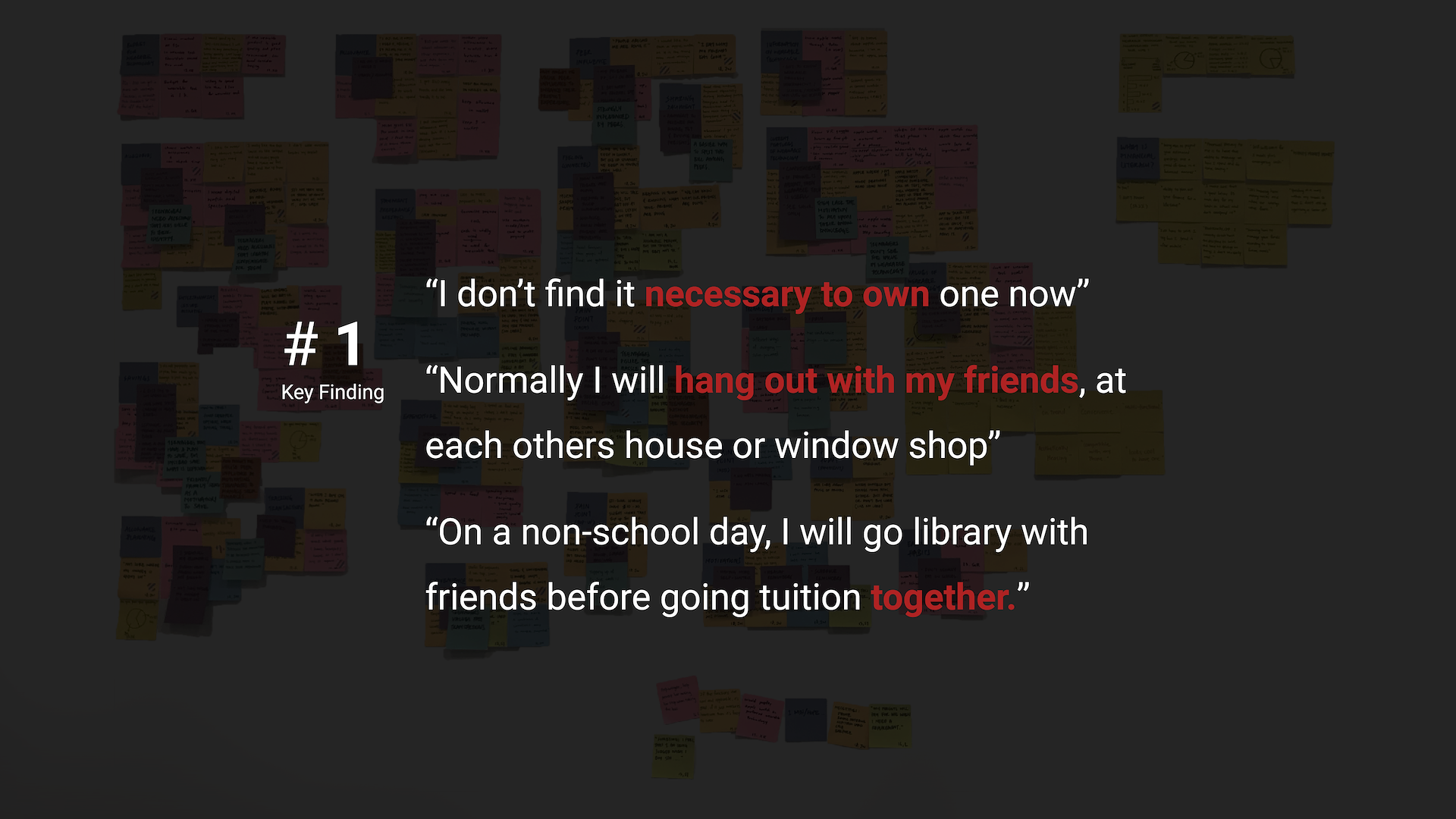

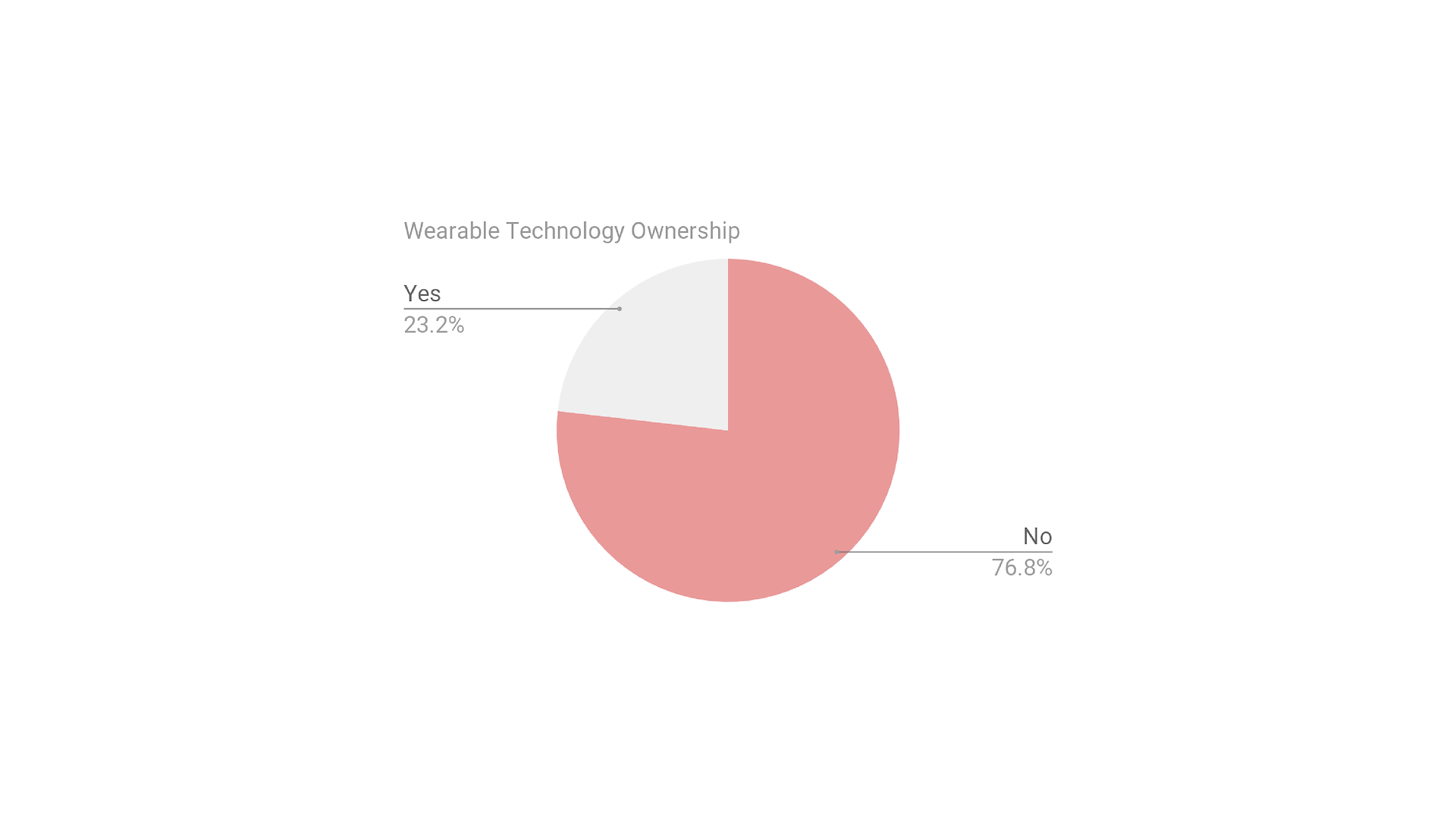

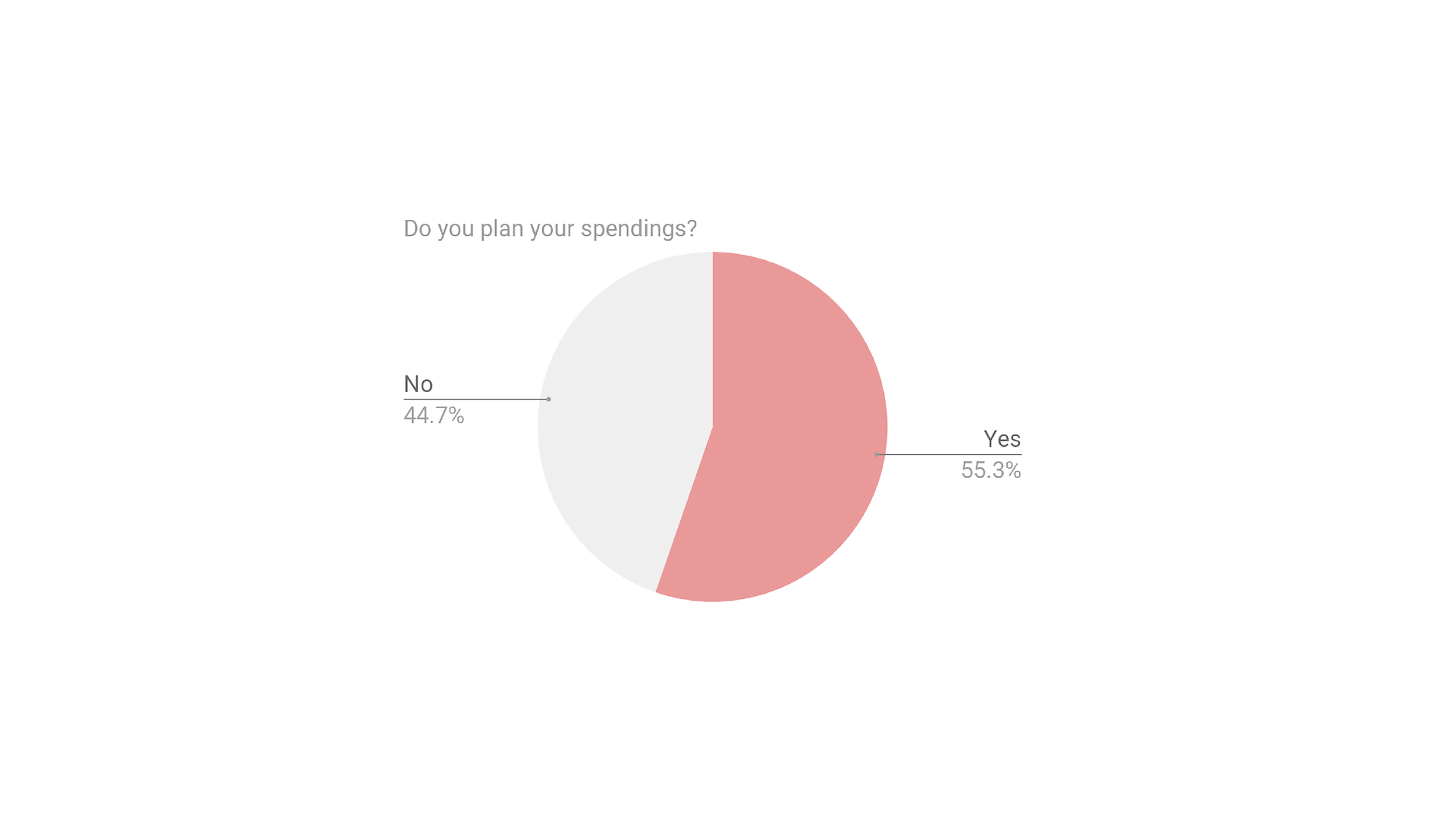

Combining with our qualitative data we got from probes and interviews we conducted surveys to gather more information about their daily wearables and spending habits

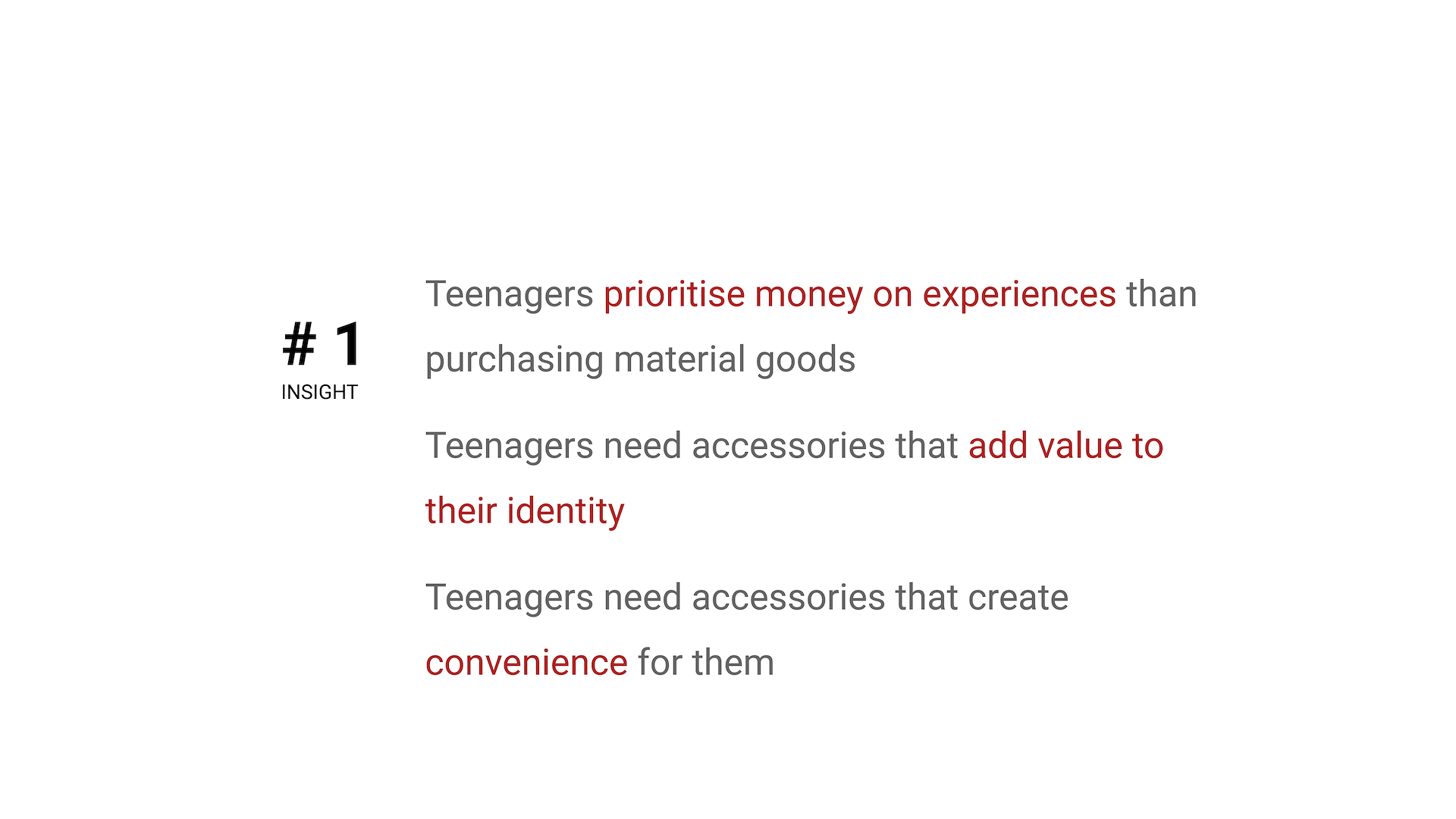

DATA ANALYSIS

Teenager

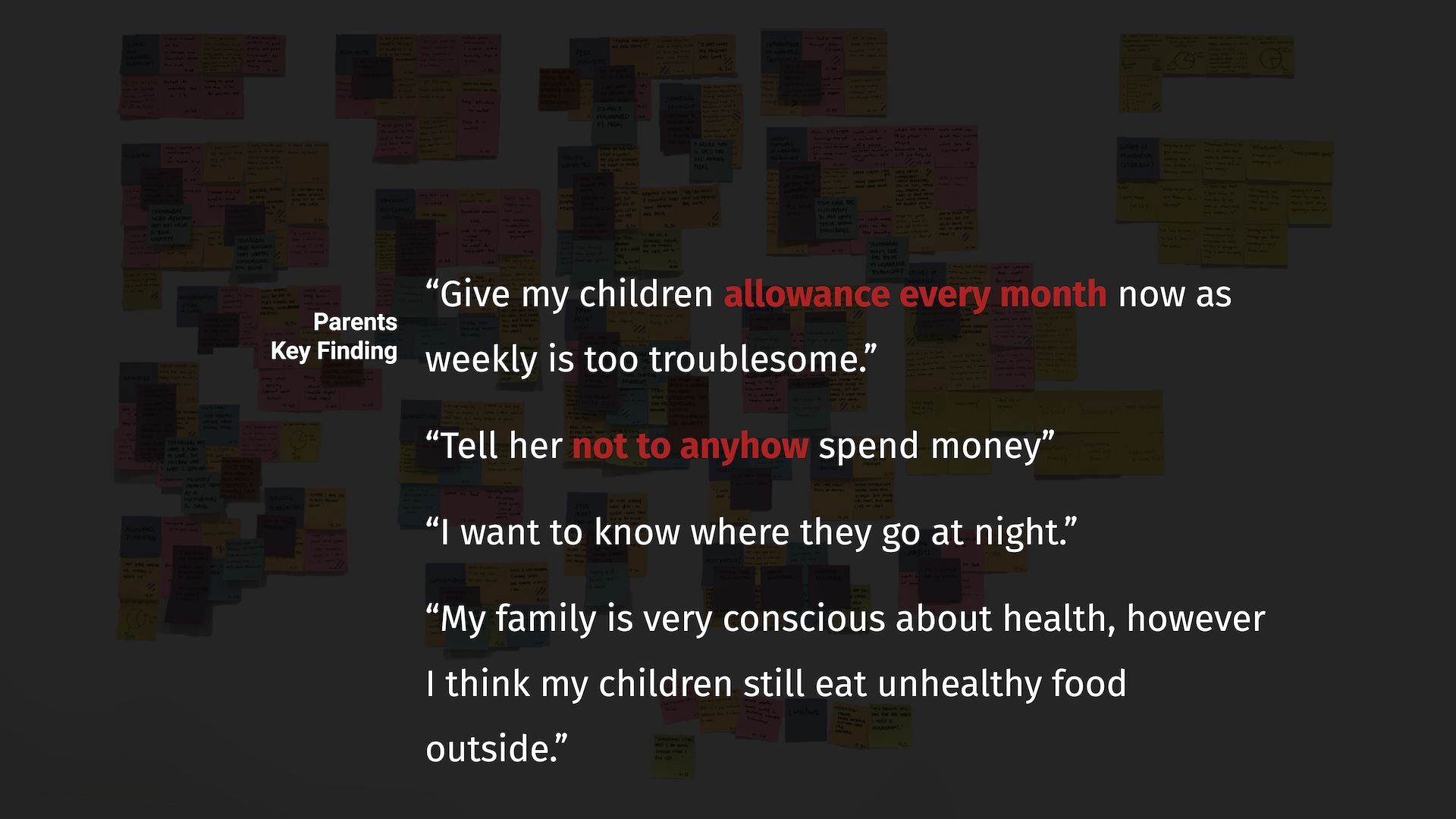

DATA ANALYSIS

Parents

CO-DESIGN WITH TEENAGERS

Finding the right wearable typology

CO-DESIGN

1) Project Introduction

2) Preparation and sensitization

3) Exposure to existing wearables

4) Mock up presentation & discussion

5) Initial concept work sheet

6) Q&A

Initial concepts

For participants to have an opinion of the typology and specifically mechanism details.

Student input

Having been well primed from the series of activities. Based from our initial concepts they could adapt it to their lifestyle.

Design Considerations

1) Modularity of wearabale technology to fit into any outfit or occsaion

2) Seamless peer to peer payment

3) Customization and personalisation

4) Spending and tracking functions on app

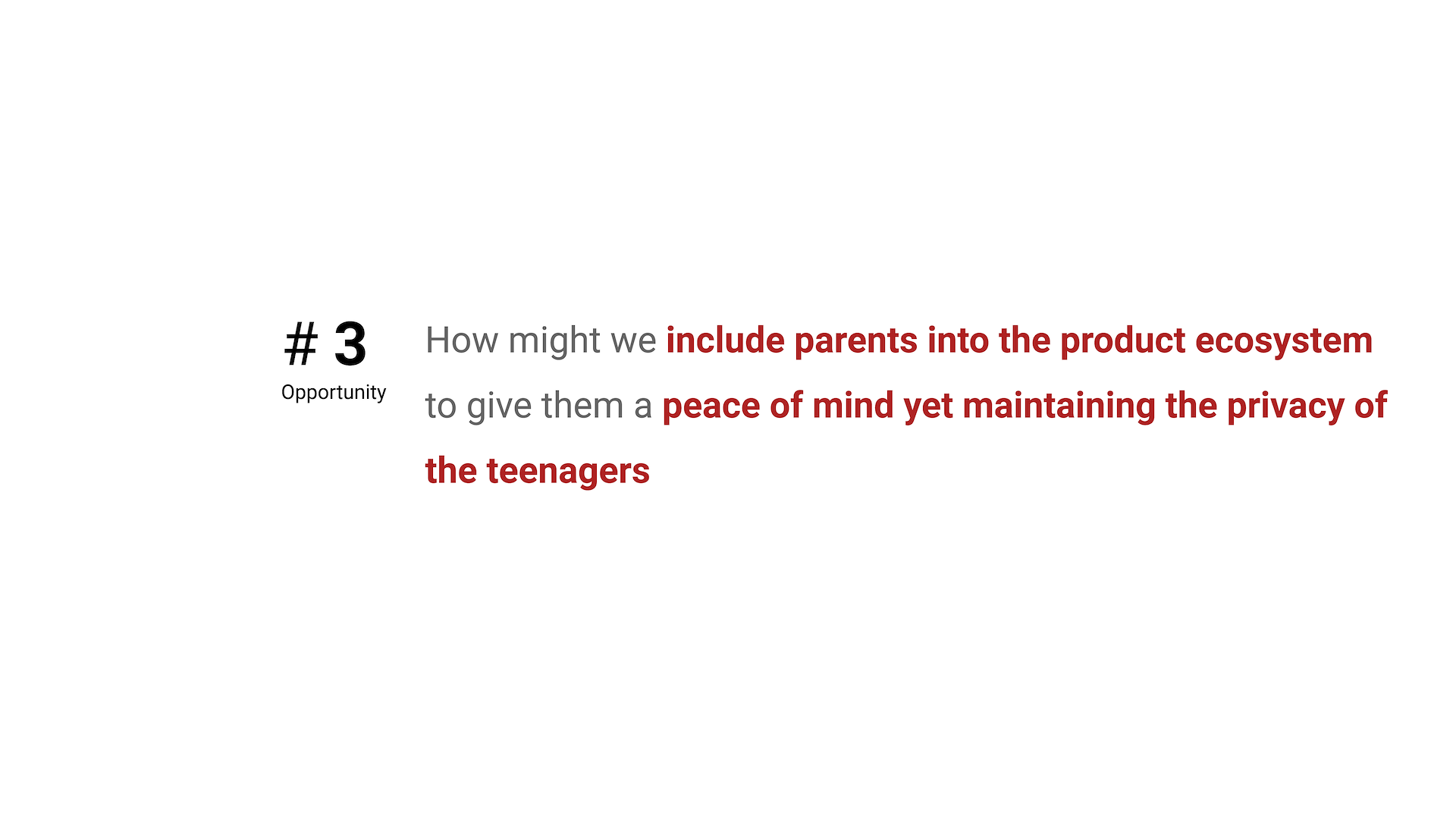

5) Parents have partial information to not invade teenager’s privacy on app

6) Hyper localising the product by using colloquial slang

CONCEPT VIDEO

WEARABLE USER INTERFACE

Using the local slang “KIAP” (pinch) as a noun to engage with the wearable. Touch sensor to navigate through the wearable. Simple colours of orange to highlight action is being operated and green with a vibrate to feedback action completed

CHILD MOBILE INTERFACE

1) Seamless tracking of spend with easy visuals

2) Saving functions with visuals for motivation

3) Seamless co-payment function

WEARABLE USER INTERFACE

1) Parents opening first time the mobile application will be informed of their limited access to their child.

2) View balance without knowing savings of children but able to see their saving progress with a visual graph without the amount value to not intrude on child’s privacy. Seeing consistent positive saving progress, parents could transfer money as reward to further incentify them to continue to save.

3) Seamless trasnfer of allowance by adding name of child and amount to transfer

USER TESTING

“Makes the process of splitting bills less troublesome”

“UI is easy to understand”

“KIAP to pay really rings a bell”

“Really like the straightforward way parents can send me money”